Am I Paying Too Much for Car Insurance? Should I Switch? | Gabi

The article was written by Dr. Hanno Fichtner, the CEO of Gabi, and an insurance expert after spending nearly a decade at McKinsey working closely with the insurance industry.

Have you wondered, “Am I paying too much for car insurance? Should I switch providers?” This is something we’d all like to know (and rightfully should). We decided to ask several thousand car owners to share how much they’re paying for their insurance, then identified better rates by looking at quotes from all major car insurance companies. Here are our findings on how likely people are to overpay for insurance–by company–and how much they could save by simply switching providers.

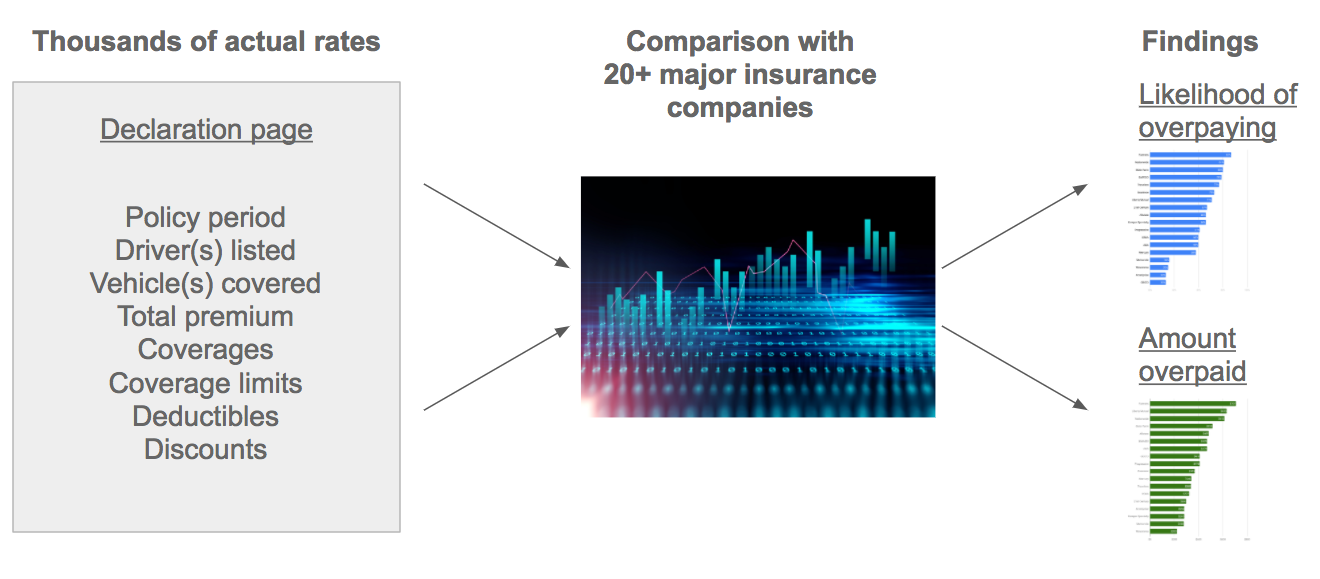

An Apples-To-Apples Comparison of Thousands of Actual Insurance Rates

Our goal was to find an objective, apples-to-apples method of comparing the rates offered by all major insurance companies. For this analysis, we used the dataset of Gabi customers and their insurance policies across the last year.

We started by looking at customer’s current insurance documents and extracted all necessary data, such as insured vehicles, drivers, miles, coverages, violations, and current rate. To be sure we were accurately capturing their specific situation, we followed up with questions if information on the declaration page was missing. We then we ran detailed comparison analytics on our rate comparison engine across 20+ insurance companies, which allowed us to inform our users if they were overpaying, and how much they could save by switching to a different insurance insurance company.

We did this for several thousands of users in California over the past several months, comparing more than 20 insurance companies including Geico, Allstate, Farmers, State Farm, Travelers, Progressive, Safeco, AAA, USAA.

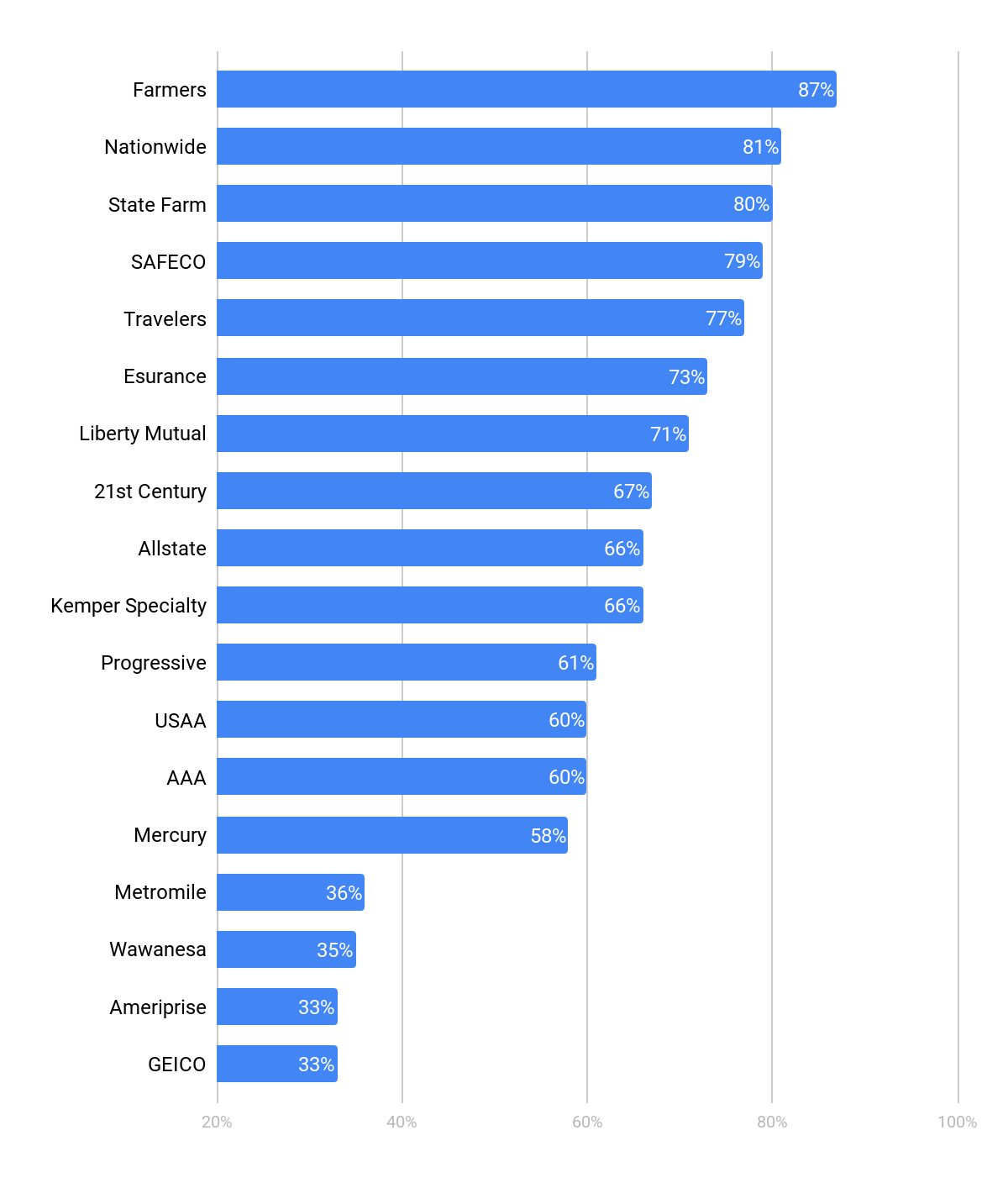

Our Findings: Here’s Who Is Most Likely to Overpay

First, let’s look into how often we were able to beat an existing rate. You see in the chart below that customers from Farmers, Nationwide and State Farm are overpaying most often. We could find a better rate for those customers in more than four out of five cases.

The insurance companies with the most competitive rates are Geico, Ameriprise, and Wawanesa. But even in that group one in three of our users is paying more than they need to. You can also see that out of the 18 companies analyzed, 15 of them have a likelihood of more than 50% of being too expensive.

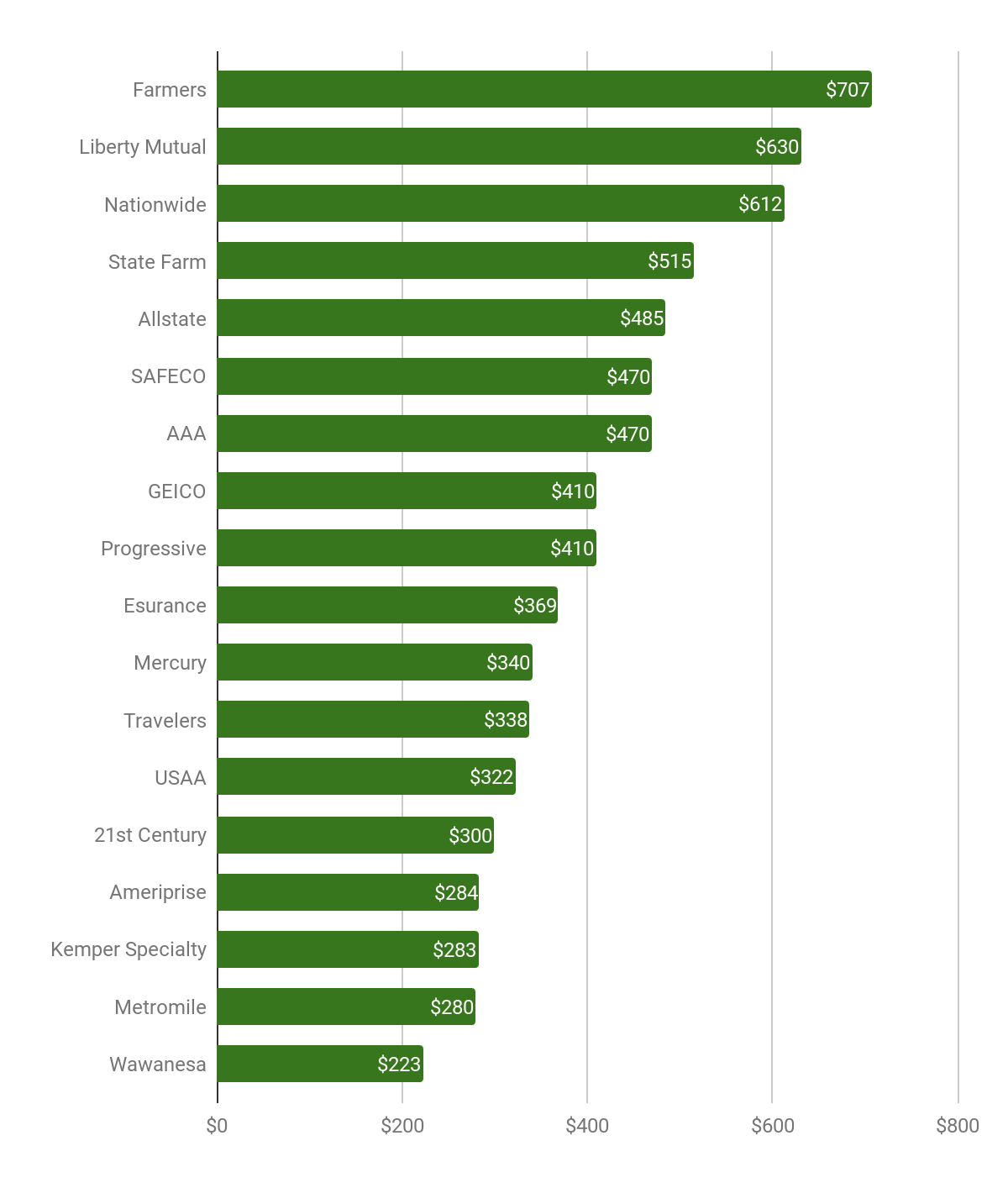

How Much People Are Overpaying

Now let’s look at how much savings we found for these major insurance companies.

Farmers is again one of the worst offenders in terms of how much consumers overpaid. We found an average savings of $707 per year on their auto insurance alone (not including multi-policy discounts). This represents savings for the comparable coverage (or even better if we could not exactly match the prior coverage) offered by competing insurance companies. If your car is insured with Liberty Mutual, Nationwide and State Farm, you’ll save $500 on average. Even with companies such as Wawanesa — a company where customers would have a low likelihood of overpaying, we were still able to find an average savings of $223.

The Reason That Insurance Companies Get Away With This

The reason insurance companies can overcharge their customers is that the market has little transparency. It is difficult to say the least for customers to compare their rates and get a full market overview. It often entails filling out endless forms, getting spam and sales calls. It’s so intimidating, people often just give up on the process and accept a higher rate.

And, even if they’ve taken the time to compare rates and have found a rate that works, this “best” rate only has a limited shelf-life — as soon as your life situation changes (purchase of a new car, moves, etc.) or your insurance company raises rates (they will), your great rate will no longer be optimal. This means that the best strategy for not overpaying is constant (or at least regular) vigilance.

This complexity and confusion in the insurance market is the reason we started gabi.com. We believe that something this important should not be so complicated.

What This Means For You

Obviously, the data presented shows averages, and each individual situation is different — the “cheapest insurance company for everyone” doesn’t exist. Your car, your miles, your coverage, your driving experience, and claims history all have an impact on what any given company can offer you. Also brand, customer service and claims handling matter when picking an insurance company. That’s why we have developed our own star rating that we send out along the rate comparison.

The bottom line: it pays off to compare your rates periodically, because it is very likely that you are overpaying. In fact, you could save on average $466 per year just by taking the time to check and get a better rate. If you don’t want to do the comparison yourself, you can have your rates automatically reviewed on gabi.com.

Gabi finds you a better home or car insurance for an average savings of $961/year.

It only takes 1 minute to register and connect your current insurance account.

Click on the button below to get started.